Ultimate Guide to Industrial-Scale Bitcoin Mining: Strategies, Costs, and Power Solutions

Introduction

Master the world of Bitcoin mining as you venture into the lucrative business of industrial-scale cryptocurrency mining. Learn the essential strategies and techniques needed for success in this comprehensive guide.

How to Begin Your Bitcoin Mining Journey?

Embark on your Bitcoin mining journey by purchasing the ideal miner for your budget and hash rate requirements. Compare various miners’ returns and payout times to make an informed decision.

Once you have your miner, select a secure Bitcoin wallet and join a reputable mining pool. Mining pools help you combine your hash rate with others, increasing the chances of earning Bitcoin rewards. Use a hash rate index to compare and choose the best mining pool for your needs.

Once you have your miner, select a secure Bitcoin wallet and join a reputable mining pool. Mining pools help you combine your hash rate with others, increasing the chances of earning Bitcoin rewards. Use a hash rate index to compare and choose the best mining pool for your needs.

Don’t forget to pay income taxes on your Bitcoin earnings, as the IRS considers mining taxable income. Report your earnings and pay taxes accordingly to stay compliant.

Choosing the Perfect Hosting Contract for Your Mining Operation

As your mining operation expands, hosting your miners in a data center becomes more cost-effective. Consider factors such as minimum order quantity (MOQ), deployment cost, maintenance fees, repair causes, and service request times when selecting a hosting contract.

Protect your investment with miners’ insurance, safeguarding your assets against theft, fire, or other disasters.

Protect your investment with miners’ insurance, safeguarding your assets against theft, fire, or other disasters.

Hosting rates for Bitcoin mining typically range from $0.05-$0.10/kWh, but they can vary significantly depending on location and the level of service provided by the hosting company.

Key factors that influence hosting rates include:

1. Geographical Location: Hosting rates fluctuate depending on the hosting facility’s location. Areas with high electricity costs or high demand for hosting services generally have higher rates.

2. Electricity Costs: The cost of electricity plays a significant role in determining Bitcoin mining hosting rates. Lower hosting rates are found in areas with cheaper electricity, while more expensive electricity leads to higher rates.

3. Service Levels: Different hosting companies offer various service levels, such as on-site technical support, 24/7 monitoring, and regular maintenance. More comprehensive service packages result in higher hosting rates.

4. Number of Miners: Possessing more miners gives you greater bargaining power to negotiate lower hosting rates.

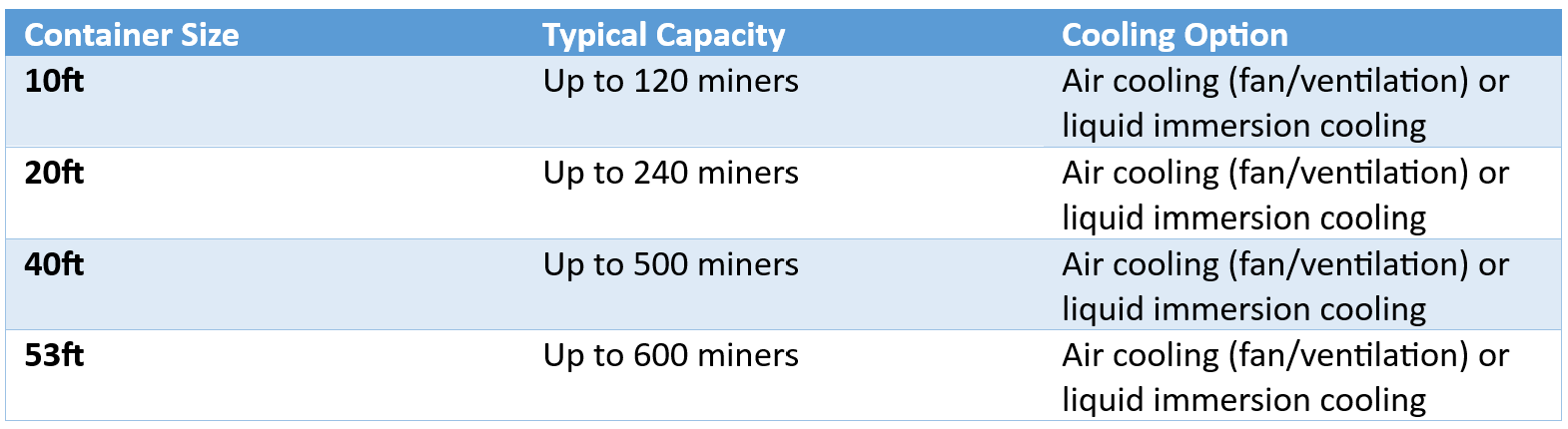

Selecting the Right Bitcoin Mining Container and Cooling Method

When choosing a bitcoin mining container, it’s essential to consider several factors to ensure a profitable investment. Here are the key aspects to take into account:

1. Size and capacity: Select a container with enough space for your current mining needs and room for future expansion. The container’s size and capacity will determine the number of miners you can host and the hashing power you can generate.

2. Cooling and ventilation: Efficient cooling and ventilation are crucial for maintaining optimal temperatures and maximizing mining performance. Opt for a container with effective cooling systems that can handle the heat generated by your miners.

3. Power supply: Ensure the container has a reliable power supply capable of delivering sufficient power to your mining equipment. Consider backup power or redundancy options for power outages or disruptions.

4. Security: As cryptocurrency mining operations can be targets for theft or hacking, select a container with adequate security measures, such as physical security, surveillance cameras, and remote monitoring.

5. Location: The container’s location can significantly impact power costs and operating expenses. Choose a location with affordable power rates, a stable electricity grid, and consider factors like climate and proximity to your mining team or resources.

6. Cost: Factor in the total cost of ownership, including the container’s purchase or lease price, installation costs, ongoing operating expenses, and maintenance or repair costs.

7. Supplier reputation: Opt for a reputable supplier with a history of providing quality equipment and services. Seek reviews and feedback from other mining operators and reach out to the supplier’s existing customers for their perspective.

Note: Actual capacity and cooling options may vary depending on container design and equipment. Liquid immersion cooling is an efficient, increasingly popular option for high-density mining equipment, though it may require more upfront investment and expertise. Air cooling is a more traditional choice, suitable for smaller operations or lower-density equipment configurations.

Hybrid model of hosting and mining

A hybrid model of hosting and mining allows you to host other miners in your container to generate a predictable cash flow to pay your operating expenses. Your operating expenses include electricity cost, technician cost, mining management software cost, power generation rental, and maintenance where applicable.

While being exposed to the price of Bitcoin can also be an opportunity for miners to benefit from price movements. For example, miners can choose to hold some of their Bitcoin earnings as an investment, in the hopes that the price of Bitcoin will increase in the future. This can provide additional potential upside beyond mining profits.

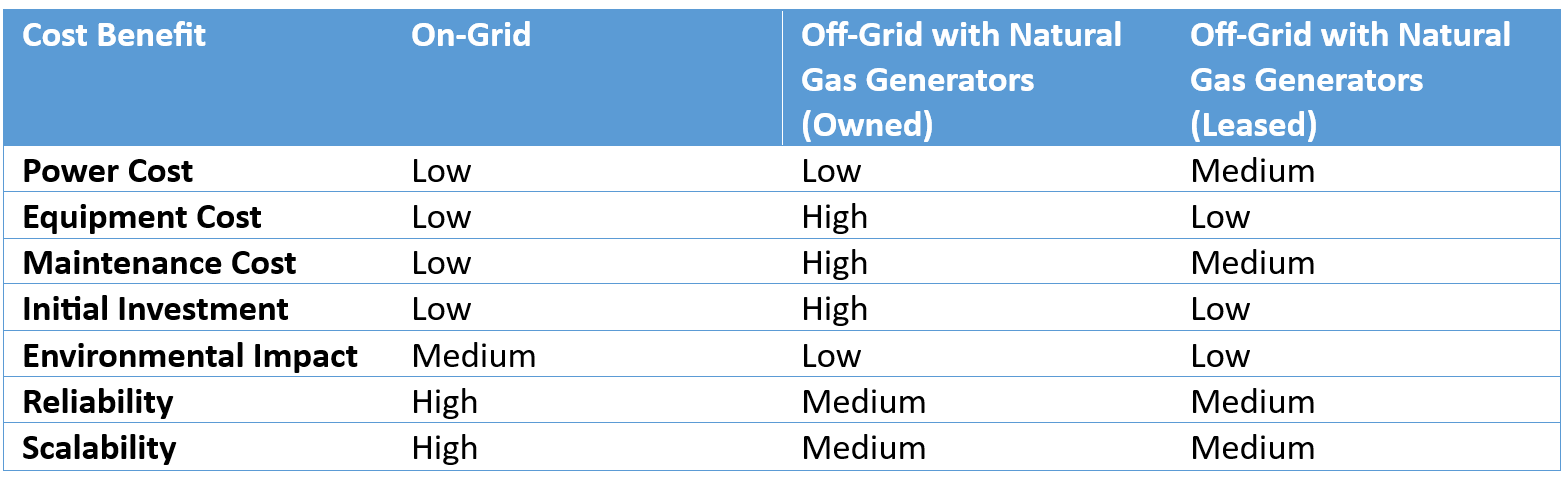

What is better on-grid or off-grid power?

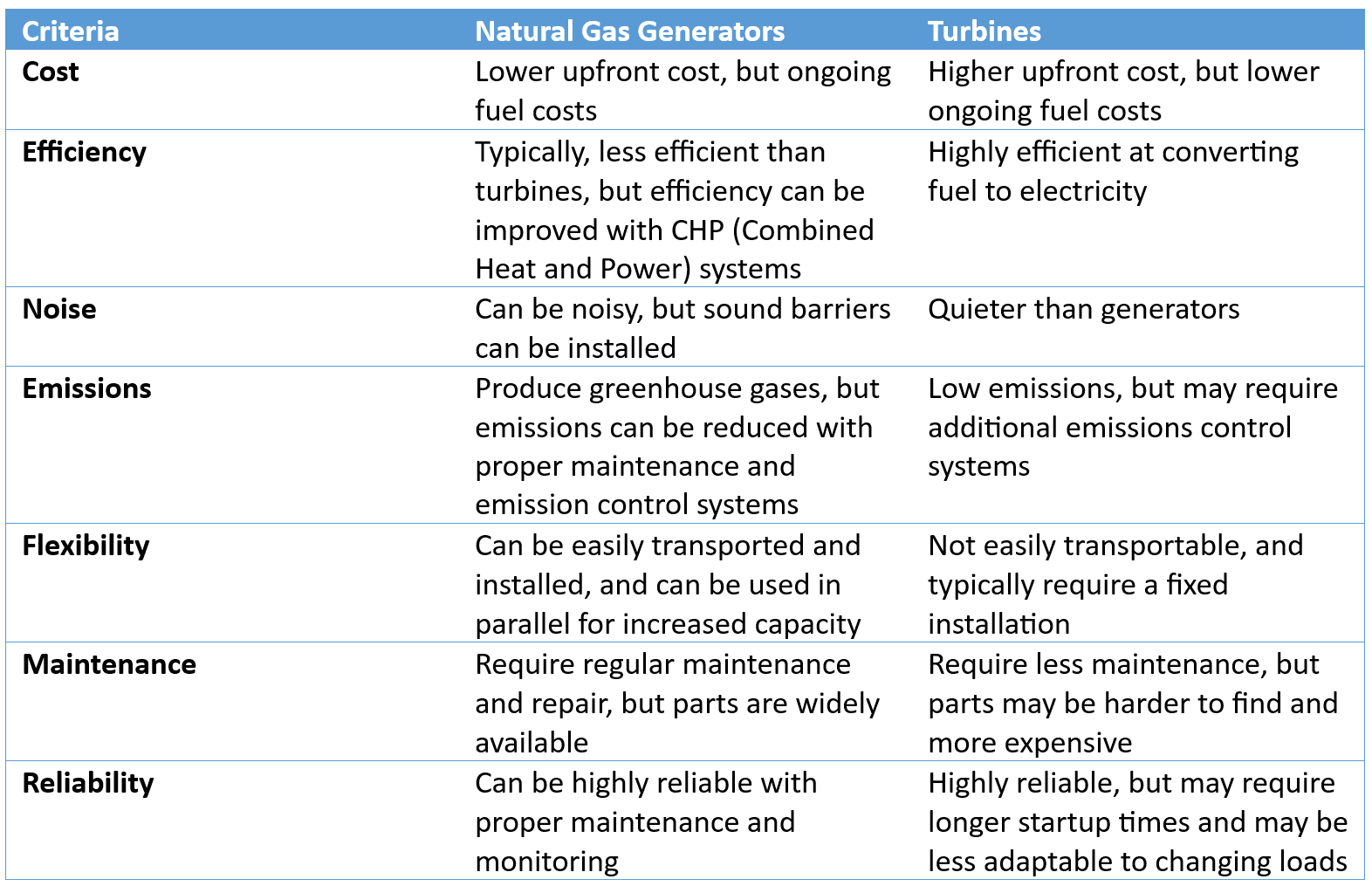

Here is a table comparing the cost benefits of on-grid vs. off-grid options for Bitcoin mining, including the use of natural gas generators only, with an additional column for leasing costs:

As you can see from the table, on-grid power generally has lower power costs, lower equipment costs, and lower maintenance costs compared to off-grid options with natural gas generators, whether they are owned or leased. However, the initial investment for on-grid power can be higher due to the need for infrastructure and installation costs.

Off-grid power with owned natural gas generators can offer lower power costs compared to on-grid power, but the initial investment and maintenance costs are still high. Leasing natural gas generators can help reduce the initial investment cost, but may lead to higher power costs and maintenance costs over time.

It’s important to consider the environmental impact of natural gas generators and ensure that they meet local regulations and emissions standards. When it comes to using natural gas generators, it’s a good idea to consider them when there is an abundant and affordable supply of natural gas in the area. This can help reduce the cost of power and make the investment in natural gas generators more cost-effective in the long run.

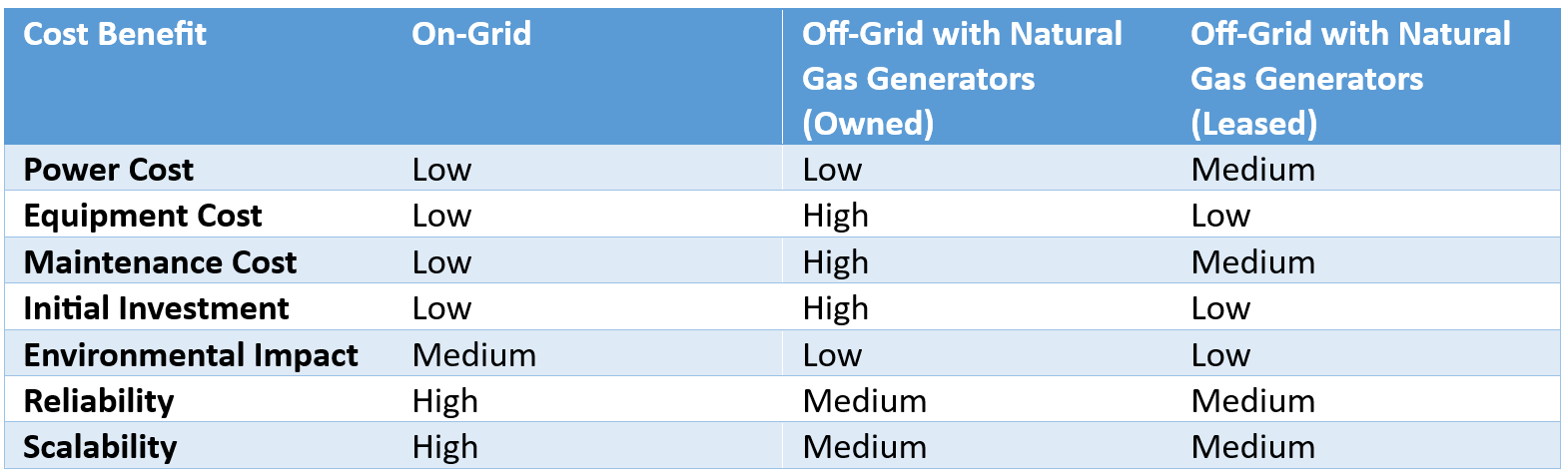

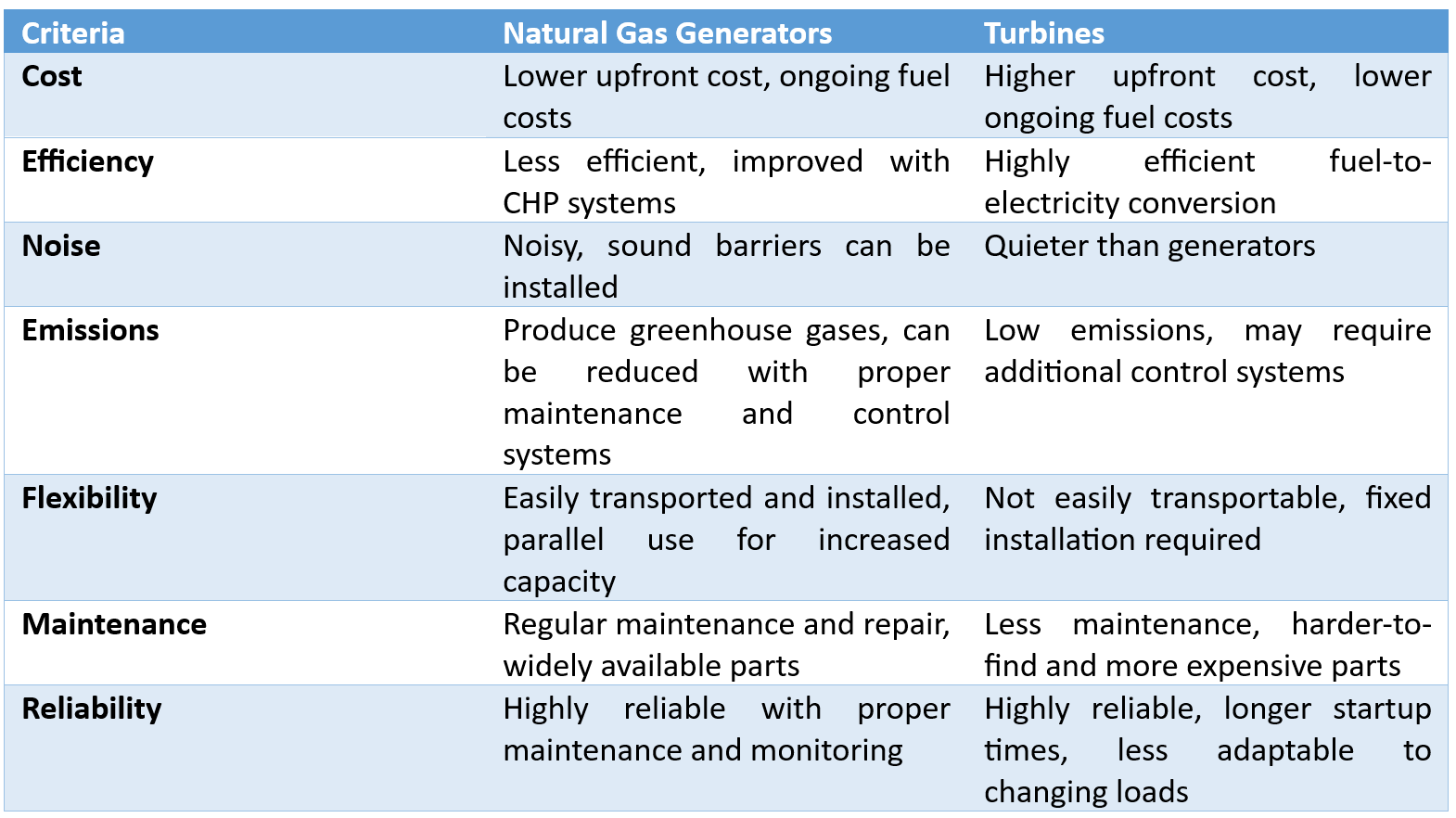

When it comes to powering a bitcoin mining operation in a remote location, natural gas generators and turbines are two popular options. Here’s a comparison of the two based on critical selection criteria, pros, and cons:

When considering natural gas generators, it’s important to select a model that can handle continuous loads for an extended period of time. Look for models with high reliability ratings and low maintenance requirements. It’s also important to consider the availability and cost of natural gas in the area, as well as any emissions regulations that may apply. Here are the steps and checks that need to be taken to make sure off-grid power supply with natural gas generator:

1. Check the generator: Before connecting the generator, it is important to ensure that it is in good working condition. Check the oil level, fuel tank, and battery.

2. Prepare the site: Clear the area where the generator will be installed. Make sure the ground is level and stable.

3. Install the generator: Install the generator according to the manufacturer’s instructions. This may involve connecting the fuel line, electrical connections, and exhaust system.

4. Test the generator: Once the generator is installed, test it to make sure it is working properly. Check the voltage and frequency output, as well as the oil pressure and temperature.

5. Connect the natural gas well: After the generator has been tested, connect it to the natural gas well. This will involve running a pipeline from the well to the generator.

6. Check the gas pressure: Before turning on the generator, check the gas pressure to ensure it is sufficient for the generator to operate.

7. Turn on the generator: Turn on the generator and monitor it closely to ensure it is operating properly. Check the voltage and frequency output, as well as the oil pressure and temperature.

8. Monitor the system: After the generator is up and running, monitor it regularly to ensure it is operating efficiently and effectively. This may involve checking the oil level, cleaning the air filter, and performing other routine maintenance tasks.

When considering turbines, look for models with high efficiency ratings and low emissions. Turbines may be a good option for larger mining operations with a more stable and predictable load, as they typically require longer startup times and may be less adaptable to changing loads. It’s also important to consider the availability and cost of fuel in the area, as well as the initial installation cost.

Hybrid Hosting and Mining Model: On-Grid vs. Off-Grid Power Options

A hybrid hosting and mining model enables you to host other miners in your container, generating a predictable cash flow to cover operating expenses. These expenses include electricity, technician fees, mining management software, power generation rental, and maintenance. Meanwhile, miners can benefit from Bitcoin price movements by holding some of their earnings as an investment, hoping the price will increase in the future.

On-Grid vs. Off-Grid Power Options for Bitcoin Mining:

On-grid power typically has lower power, equipment, and maintenance costs compared to off-grid options. However, initial investment for on-grid power may be higher due to infrastructure and installation costs. Off-grid power with owned natural gas generators can offer lower power costs but higher initial investment and maintenance costs. Leasing generators can reduce initial investment cost but may lead to higher power and maintenance costs over time.

Consider the environmental impact, local regulations, and emissions standards when using natural gas generators. These generators can be cost-effective when there is an abundant, affordable supply of natural gas in the area.

Comparison of Natural Gas Generators and Turbines for Remote Bitcoin Mining:

When selecting natural gas generators, choose models with high reliability ratings and low maintenance requirements. Consider the availability and cost of natural gas and any emissions regulations. Follow the necessary steps and checks to ensure a proper off-grid power supply with a natural gas generator.

When considering turbines, opt for models with high efficiency ratings and low emissions. Turbines are suitable for larger mining operations with stable, predictable loads but require longer startup times and are less adaptable to changing loads. Also, consider fuel availability, cost, and initial installation expenses.

Increasing Capital Exposure and Ownership with a Power Purchase Agreement (PPA) Contract for Bitcoin Mining

You can boost your capital exposure and ownership by securing a Power Purchase Agreement (PPA) contract. This enables you to lease a site with on-grid power and participate in curtailment and demand response programs.

Here are the general steps to obtain and negotiate the best terms for a PPA contract as a Bitcoin miner:

1. Identify potential energy suppliers: Research potential energy suppliers in areas where you plan to operate your mining facility. Focus on electricity providers offering renewable energy sources, as they may be more likely to enter a PPA agreement.

2. Determine your energy needs: Calculate your energy requirements based on your mining equipment capacity and operating hours. This estimate will inform the amount of energy you need to purchase from the supplier.

3. Contact energy suppliers: Inquire about PPA options with the energy suppliers you identified. Some may already have a PPA program, while others may be open to negotiating terms.

4. Compare and negotiate terms: Assess the PPA options and negotiate terms that best meet your needs. Consider factors such as price per kWh, contract length, and penalties or incentives for excess or shortfall energy consumption.

5. Seek legal advice: Consult with legal counsel to ensure the PPA contract is fair and complies with local regulations. Work with a lawyer experienced in energy and Bitcoin mining contracts.

6. Sign the contract: Once satisfied with the terms and after legal review, sign the PPA contract and start purchasing energy from the supplier.

Consider participating in curtailment programs when negotiating a PPA contract. Curtailment programs involve agreements between energy suppliers and consumers, where the consumer agrees to reduce energy consumption during peak demand periods in exchange for lower rates. These programs can help Bitcoin miners cut energy costs and boost profitability.

Key factors to consider when negotiating a PPA contract with a curtailment program:

1. Curtailment rate: Aim to negotiate a high curtailment rate for the energy supplier to compensate you for reducing energy consumption during peak demand periods, maximizing potential earnings.

2. Curtailment notification and procedures: Ensure the contract specifies how the energy supplier will notify you of a curtailment event and the required procedures for reducing energy consumption.

3. Flexibility: Negotiate a curtailment program that allows flexibility in reducing energy consumption. For instance, you may reduce power consumption for some mining equipment without completely shutting down your operation.

4. Demand response program: Some energy suppliers offer demand response programs that let you sell excess energy back to the grid during high-demand times, providing additional potential revenue.

By considering these factors and following the steps above, you can secure and negotiate the best possible terms for a PPA contract as a Bitcoin miner.